Types of Forms

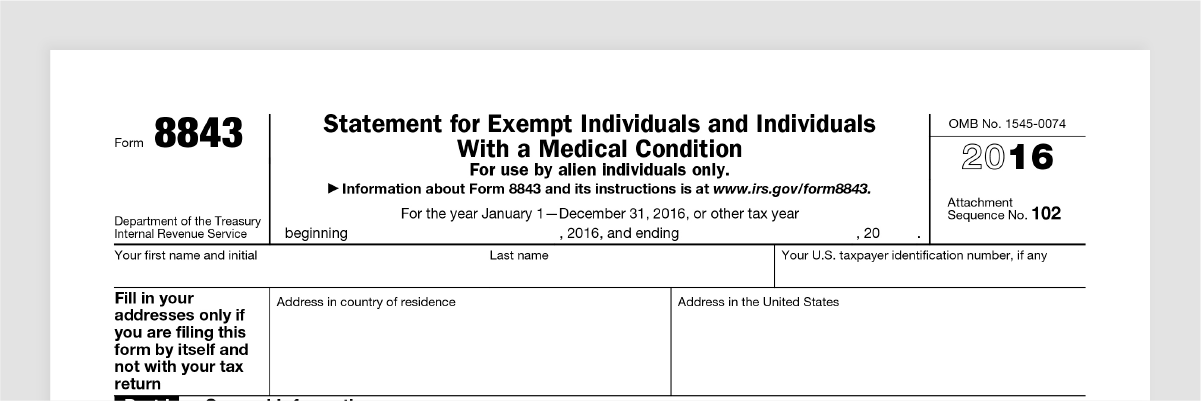

8843

Filing this form is mandatory.

It lets the Internal Revenue Service (IRS) know if you are a non-resident alien or a resident alien for tax purposes, and is especially important if you plan to work and live in the U.S. in the future.

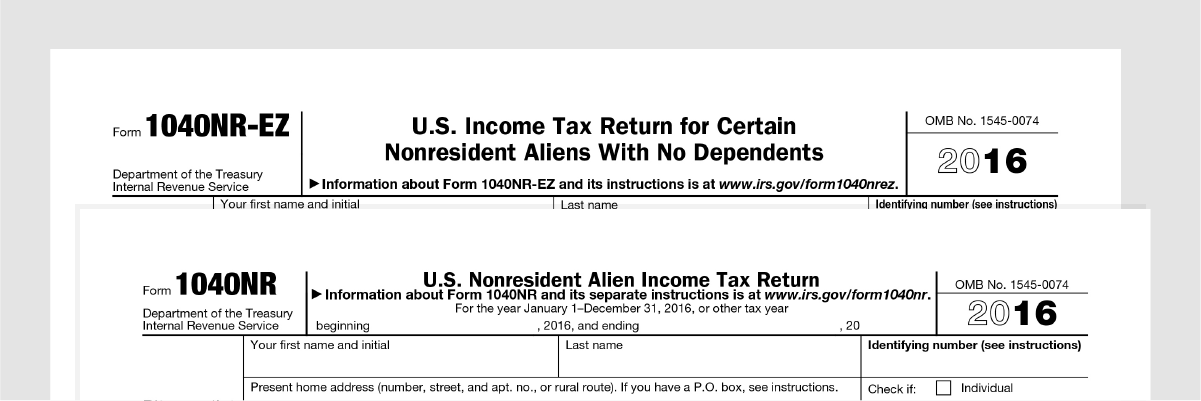

1040NR

This form is for non-resident aliens and is mandatory if you have earned income during the year.

This form is for filing federal tax returns. Form 1040NR is for non-resident aliens with dependents, while 1040NR is for non-resident aliens with no dependents.

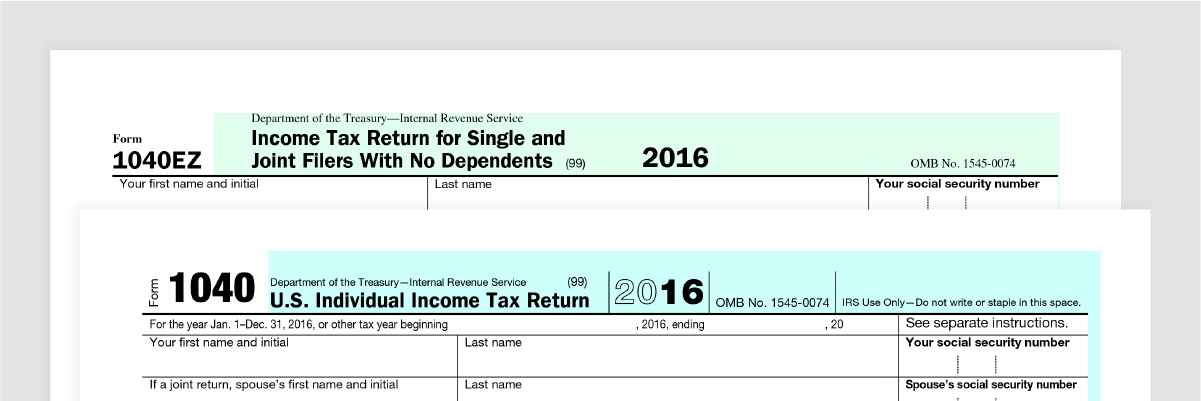

1040

This form is for resident aliens and is mandatory if you have earned income during the year.

This form is for filing federal tax returns. Form 1040 is for resident aliens with dependents, while 1040 is for resident aliens with no dependents.

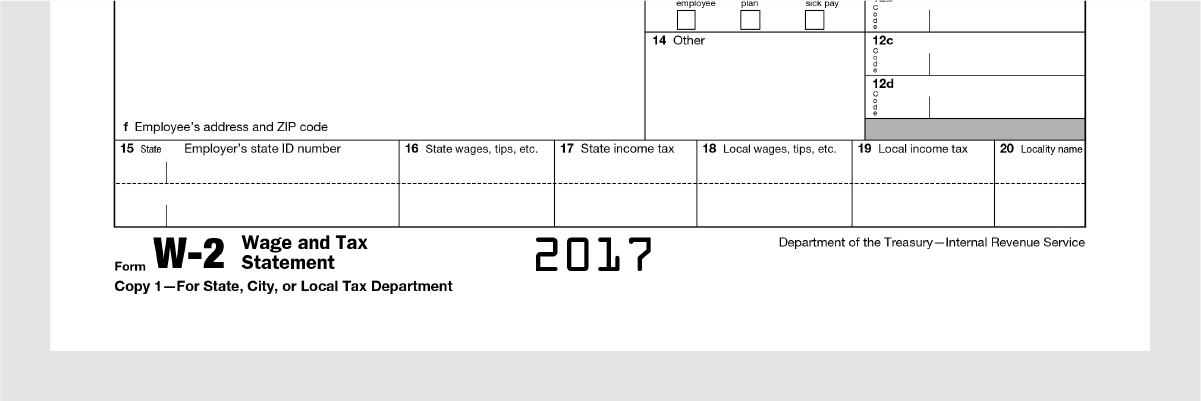

W-2

This form summarizes your earnings from a particular job. This is sent to you at the end of the year by your employer.

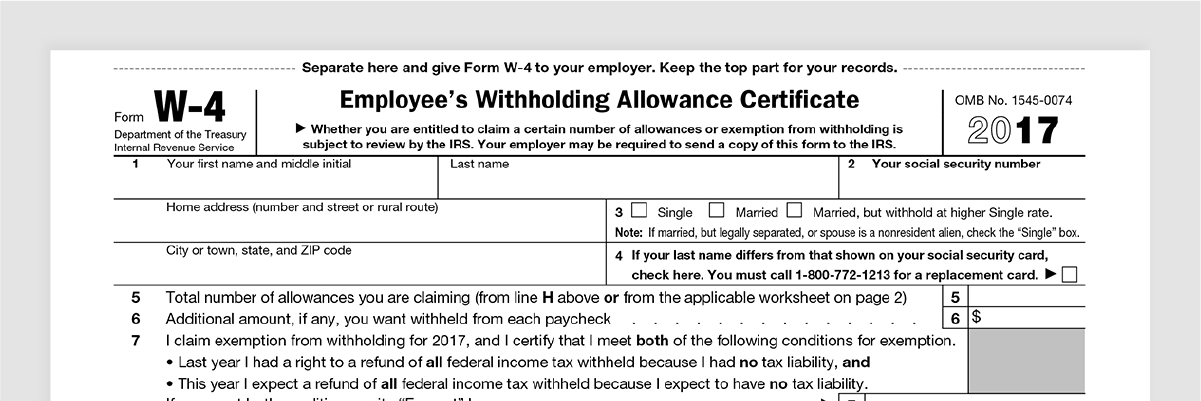

W-4

This form is for submission to your employer.

It tells your employer how much they should deduct from your income to pay for taxes.

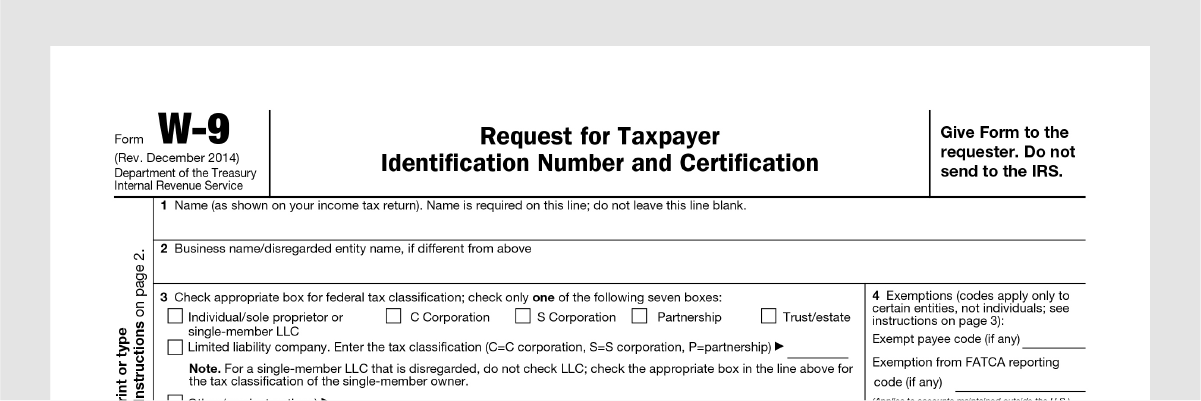

W-9

This form is similar to Form W-4, but is used by U.S. citizens and resident aliens.

It tells your employer how much they should deduct from your income to pay for taxes.