I have earned money this year.

During the past year, you have legally earned some money. This means that you need to report those earnings to the IRS, and pay any taxes required.

Step 1

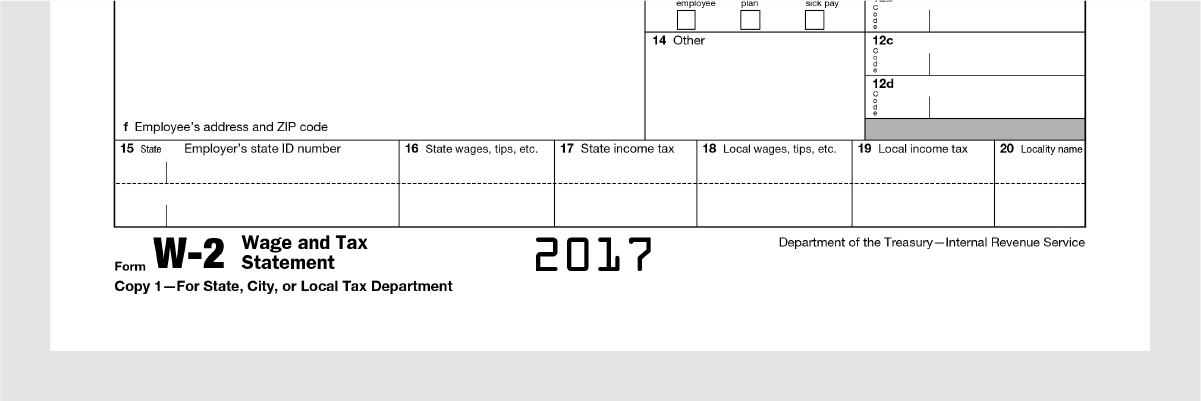

Check your wages and taxes for the year by looking at your W-2 form(s). These should have been mailed to you by your employers.

If you have earned less than $4,080

in the past year, skip to step 3.

If you have earned more than $4,080

in the past year, move on to step 2.

Step 2

Determine if you are a non-resident alien

or a resident alien for tax purposes.

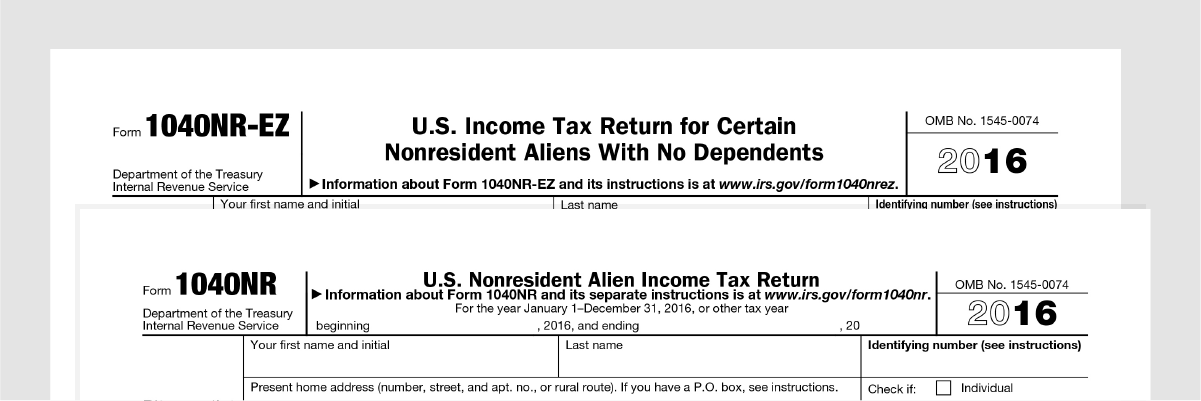

If you are a non-resident alien, complete Form 1040NR or Form 1040NR-EZ.

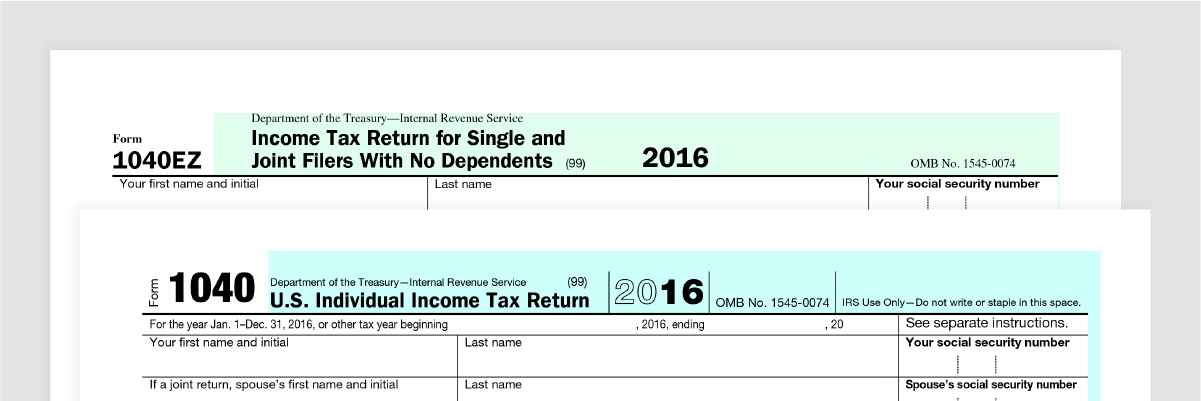

If you are a resident alien, complete Form 1040 or Form 1040-EZ.

Step 3

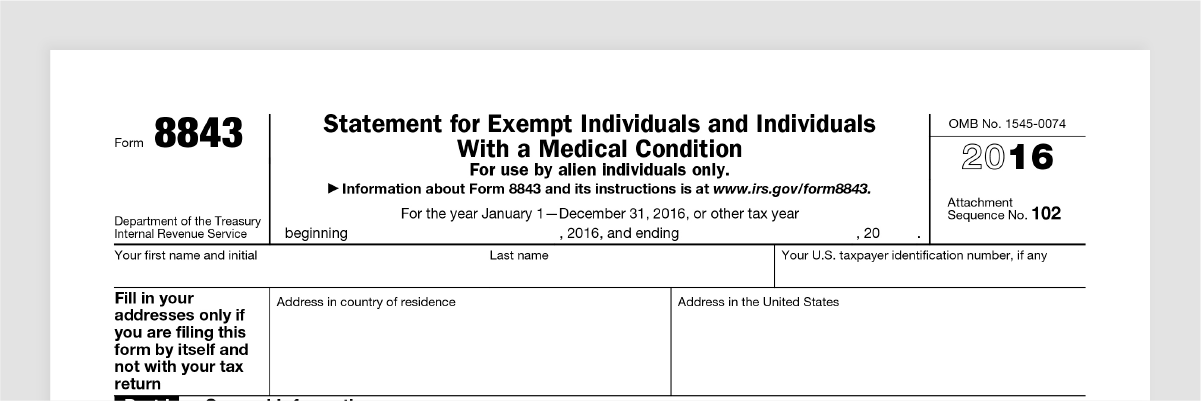

Complete Form 8843. This will let the IRS know your status as an F-1 Visa.

Step 4

Mail the forms to the IRS by April 18th. Mail it to:

Department of the Treasury,

Internal Revenue Service Center,

Austin, TX 73301-0215